The Vodafone (LSE:VOD) share price had dipped nearly 3% by 11am on Tuesday 14 November after the company’s H1 results were reported. Despite outperforming some estimates, the FTSE 100 company reported a basic loss per share of €1.28, down from a profit of €3.37 the year before.

Just two times earnings?

On paper, this is among the most interesting stocks on the index. That’s because it trades for a little under two times 2023 earnings. However, the deeper we delve, the more we can see that this is rather misleading.

This price-to-earnings ratio is based on reported earnings for the year ended 31 March 2023. During the year Vodafone delivered after-tax earnings of €11.84bn. That’s £10.31bn at the current exchange rate, and is pretty much half the current £20.6bn market cap.

Should you invest £1,000 in Ashtead Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Ashtead Group Plc made the list?

However, 2023 earnings were distorted, and this can be attributed to significant one-off events. The sale of Vantage Towers for €8.61bn and operations in Ghana for €689m had a substantial impact on the company’s adjusted earnings, contributing to the overall distortion in earnings.

On a non-adjusted basis, Vodafone is trading around 7.4 times 2023 earnings.

H1 earnings

On a forward basis, Vodafone is trading around 10.7 times earnings. That’s because 2024 is likely to be a less profitable year than 2023, even on a non-adjusted basis.

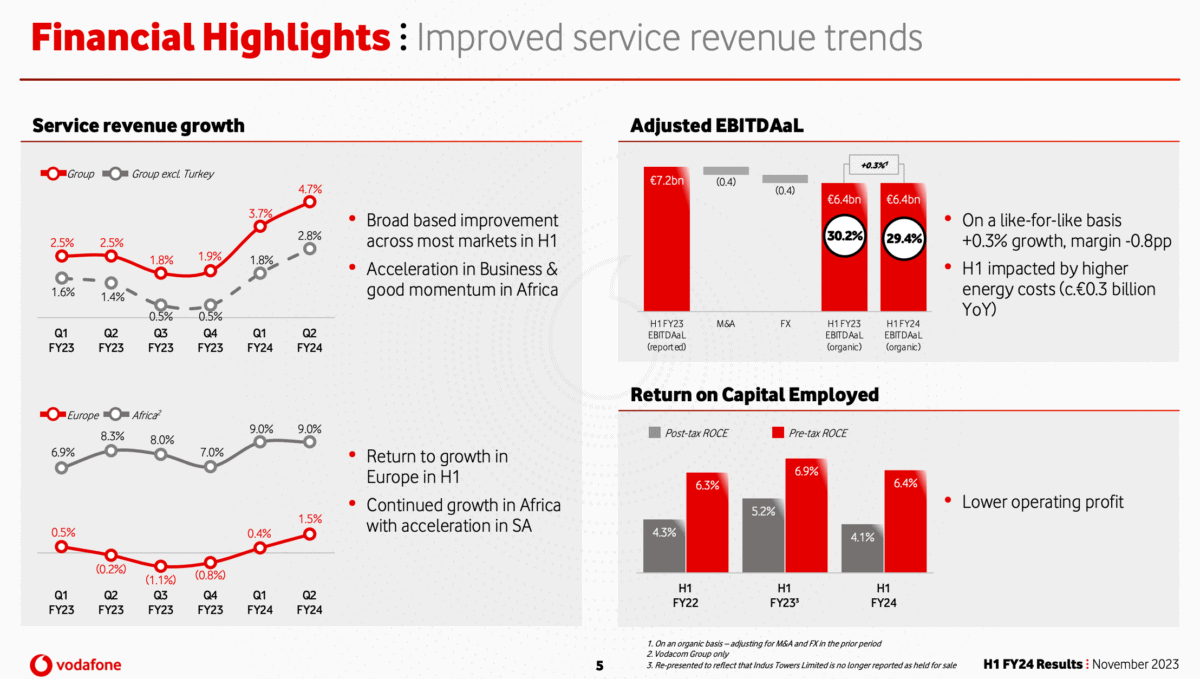

On Tuesday 14 November, Vodafone released its H1 earnings. The company reported second-quarter sales growth that beat analysts’ estimates with a surprising growth in service revenue in Germany — its biggest market. The overall organic rise in service revenue (4.7%) came in above estimates of 4.1%.

Vodafone kept its guidance for FY24 intact and retained its hefty dividend — the dividend yield currently sits at 10.3% — making it one of the biggest payers on the FTSE 100.

On another positive note, net debt now stands at €36.2bn, down from €45.6bn a year previously. A major reason for this is the sale of business units, positively impacting cash holdings and allowing for debt repayments.

Worth the risk?

Over one year, two years, three years, and five years, the Vodafone share price has fallen. Revenues have stagnated while earnings have fallen. Meanwhile, its heavily leveraged position has certainly put some investors off. Negative investor sentiment, a lack of positive momentum, and poor returns. It’s not very enticing.

So, is there a brighter future ahead? Well, there’s some hope in the medium-term earnings forecast. It’s always positive to see earnings data improve year after year.

| 2024 | 2025 | 2026 | |

| Basic EPS (p) | 5.3 | 6.1 | 7.9 |

| P/E | 10.7 | 9.3 | 7.2 |

However, this data may still raise eyebrows as Vodafone looks set to maintain a 9¢ (7.9p) dividend for 2024. The sale of its Spanish operations for €4.1bn will likely provide the cash flow to support the dividend this year, but it doesn’t appear a sustainable model going forward. This is probably why analysts see the dividend falling to 8¢ (7p) in 2025.

So, is Vodafone worth the risk? Well, not for me right now. I think there are cheaper options on the FTSE 100 with better growth prospects and less debt. Nonetheless, I appreciate the dividend remains attractive. As such, this is a stock on my watchlist.